Table of Content

With a new home loan, you are required to pay upfront fees of 3% to 6% of the loan amount. This is a significant expense that needs to be considered when refinancing. When you refinance frequently or sell your home soon after refinancing, you may not experience enough savings to justify the upfront fees.

Rates for 30-year fixed, 15-year fixed, 5/1 ARMs and jumbo loans all moved lower. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. To increase your chances of getting the best rate, you can take a few steps including raising your credit score, saving up for a larger down payment, and shopping around a few different lenders.

Home loan interest rates: What your bond will cost in 2022

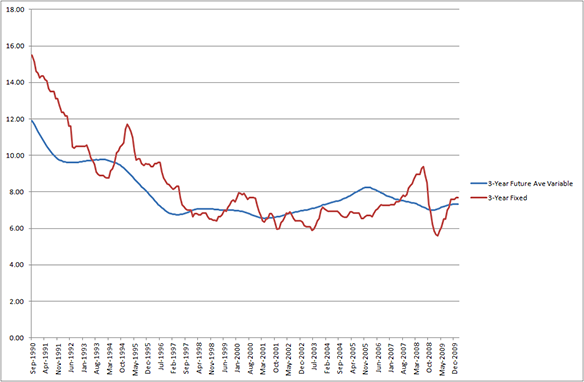

These shorter loans are a compromise compared to the more popular 30- and 15-year terms. Compared to a 30-year loan, you’ll pay down your balance quickly, while paying less interest to your lender. When interest rates are high or rising, consumers frequently opt for ARMs.

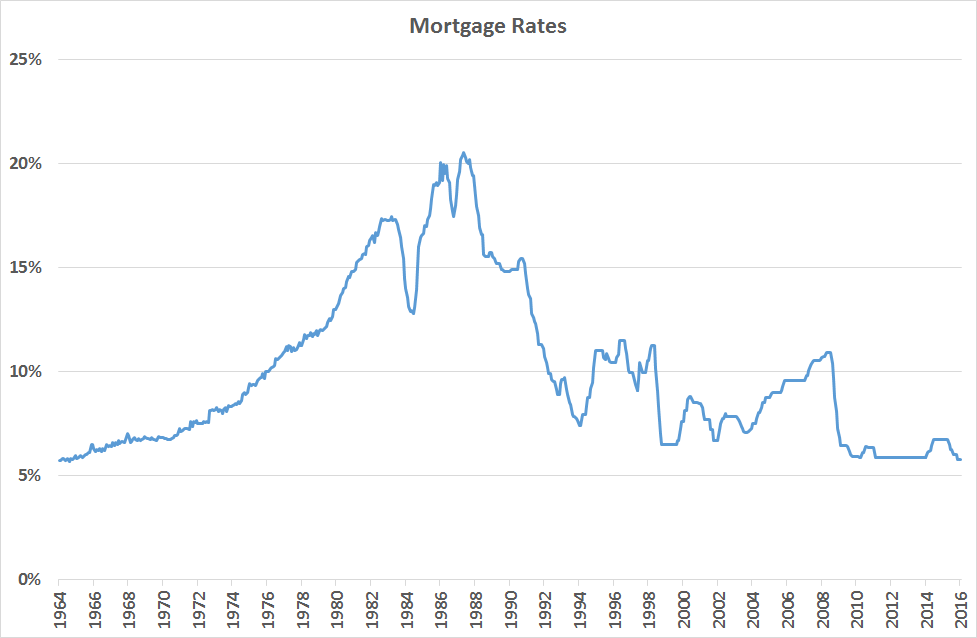

Be sure you take all factors into consideration before refinancing, not just the interest rate. However, record-low rates were largely dependent on accommodating, Covid-era policies from the Federal Reserve. And the more U.S. and world economies recover from their Covid slump, the higher interest rates are likely to go. Let’s look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

Cons of a 20-year fixed-rate mortgage

If you plan to use a gift for your down payment, you’ll need to provide a detailed paper trail showing where the money came from. The interest rate on a home loan will vary depending on what the bank is willing to offer, and how much of a risk they consider you to be. The central bank is expected to raise rates by 75 basis points for a fourth straight time at the conclusion of its next policy meeting on Nov. 1-2. You'll be paying more in interest fees on a 20-year mortgage than if you had a 10- or 15-year mortgage, which means it'll be more expensive. With high inflation lingering longer than initially expected the Federal Reserve has raised interest rates three times.

Here you can see the latest marketplace average rates for a wide variety of purchase loans. The interest rate table below is updated daily to give you the most current purchase rates when choosing a home loan. Borrowers interested in refinancing hold the best possibilities of ideal timing for a new loan.

Comparing 20-year Mortgages to Other Loan Terms

Remember that when comparing different loan offers, you should look not only at the interest rate, but also the closing costs and other fees. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage, as they generally have a lower rate than that of a 30-year, fixed-rate home loan. But keep in mind that you’ll have higher monthly payments since you’re paying off your loan in half the time .

If you’re considering a 20-year fixed over a 30-year fixed mortgage, keep in mind that the 20-year mortgage has a higher monthly payment. For example, on a 30-year fixed rate mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,111 . But a 20-year fixed rate mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.00%, the monthly payments would be about $1,331 . Even with a lower rate, the monthly payments can be higher for a 20-year fixed mortgage than a 30-year fixed mortgage. The higher monthly mortgage payment may not meet your budget or affordability. Since the rates on ARMs are usually initially lower than fixed-rate loans and if you’re planning to sell your home in a few years, it may make sense to go with an ARM vs. a fixed-rate loan.

Credible average mortgage rates and mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible. To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments. This calculator will help you compute a monthly payment and a loan amortization schedule. First enter the home price and the loan you would need to secure to make the purchase. Then provide a suitable interest rate, loan term, real estate tax percentage, annual homeowners insurance percentage, and a prime mortgage insurance percentage.

Your monthly payments will be higher than they would be with a 30-year loan, meaning that you may experience a squeeze if you experience a job loss or decrease in income. On the other hand, if you’re struggling to afford your monthly payment, a 20-year loan might pose a challenge. That’s because a 20-year loan’s monthly payments will be higher than a 30-year loan for the same amount. Information provided on Forbes Advisor is for educational purposes only.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Before you apply, try to get your credit score in the best shape possible and make sure you have all your paperwork ready. Mortgages lasting 20 years aren’t as common as 30-year mortgages, but they can be a very smart choice.

Rates plummeted in 2020 and 2021 in response to the Coronavirus pandemic. By July 2020, the 30-year fixed rate fell below 3% for the first time. And it kept falling to a new record low of just 2.65% in January 2021.

So rather than looking only at average rates, check your personalized rates to see what you qualify for. And Veterans Administration loans, which are for veterans, active-duty service members and their spouses, have no minimum credit score requirements. USDA loans, which help very low-income Americans buy in certain rural areas, also have no minimum credit score requirements.